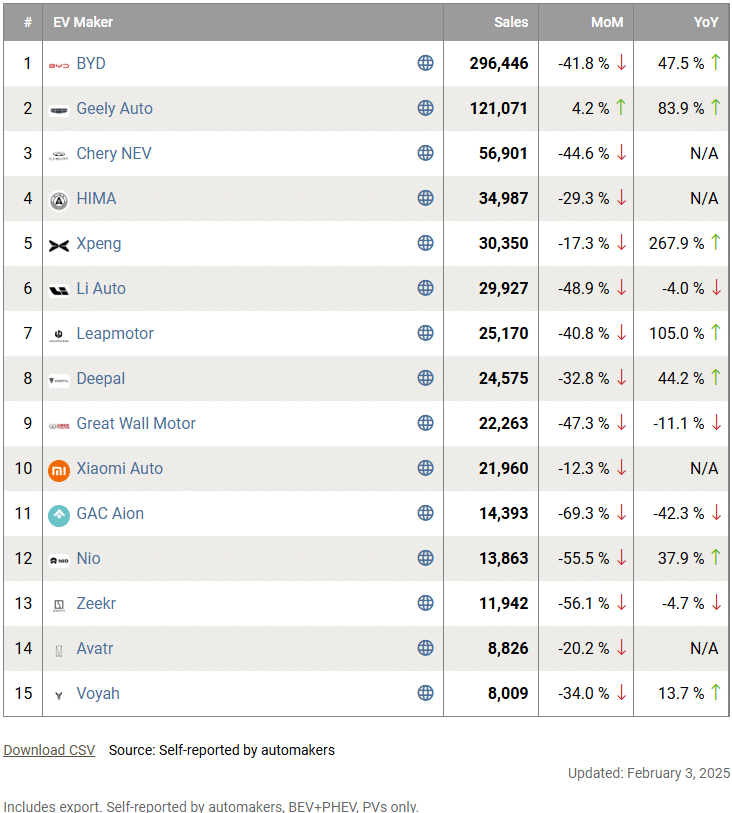

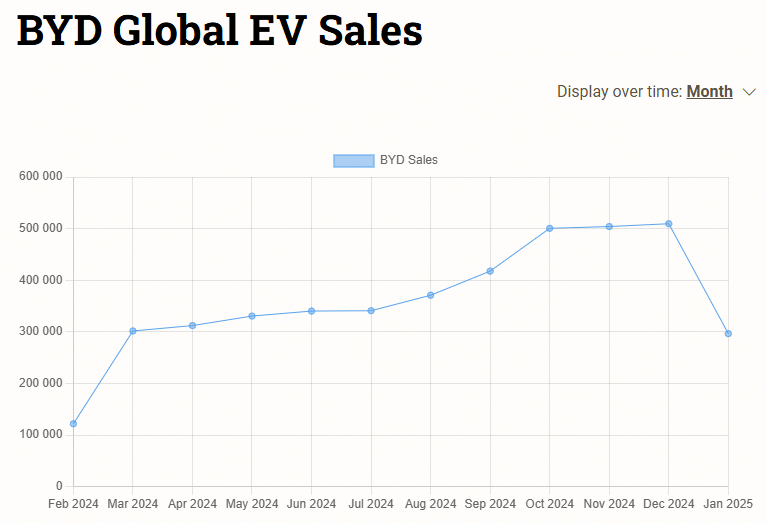

In January 2025, all Chinese EV manufacturers’ sales fell month over month except Geely. NIO fell 56%, Xpeng 17%, and BYD 42%, while Geely rose 4% from December. Li Auto lost to EV startup Xpeng.

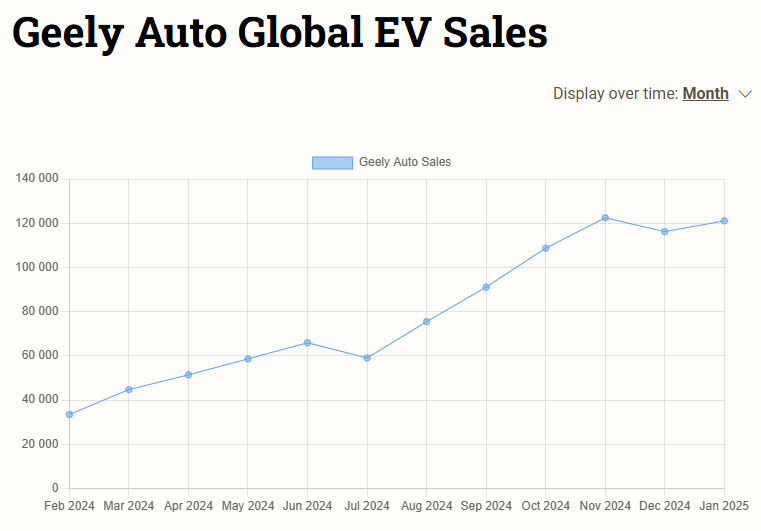

Nio brand sales fell from the previous year, but group sales rose primarily due to Onvo. Geely Auto was the only automaker to boost EV sales compared to December despite Chinese New Year. Xiaomi’s numbers are strong.

Company filings or social media updates on the first of each month provide all delivery statistics. Xiaomi only gives imprecise numbers like “20,000+” units. New energy vehicles (NEVs)—BEVs, PHEVs, and FCEVs—were sold in China. Chinese hydrogen FCEV sales are negligible.

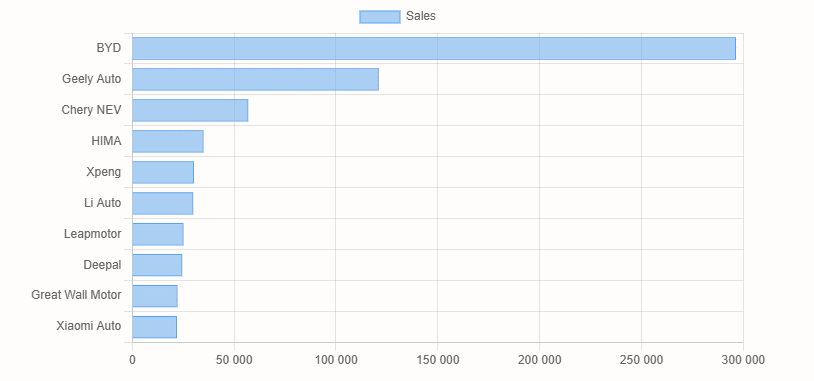

BYD sold 296,446 passenger NEVs in January 2025, down 41.8% from 509,440 in December and up 47.5% from 201,019 the year before. Geely Auto sold 121,071 passenger NEVs in January 2025, up 4.2% from December’s 116,206 and 83.9% over last year’s 65,959. HIMA sold 34,987 EVs in January, down 29.3% from December’s 49,474.

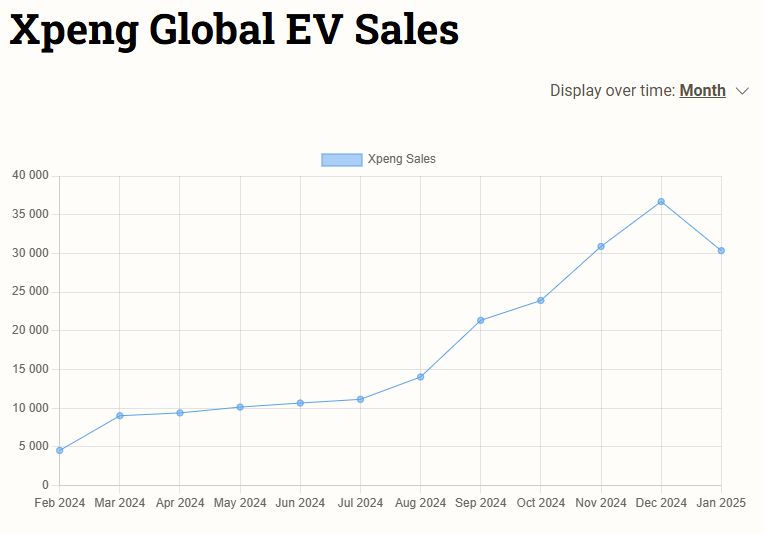

Xpeng sold 30,350 passenger NEVs in January 2025, down 17.3% from 36,695 in December and up 267.9% from 10,668 the year before. Mona, Xpeng’s entry-level brand, drove half of its sales. January 2025 saw Li Auto sell 29,927 passenger NEVs, down 48.9% from 58,513 in December and 4.0% from 31,165 the year before.

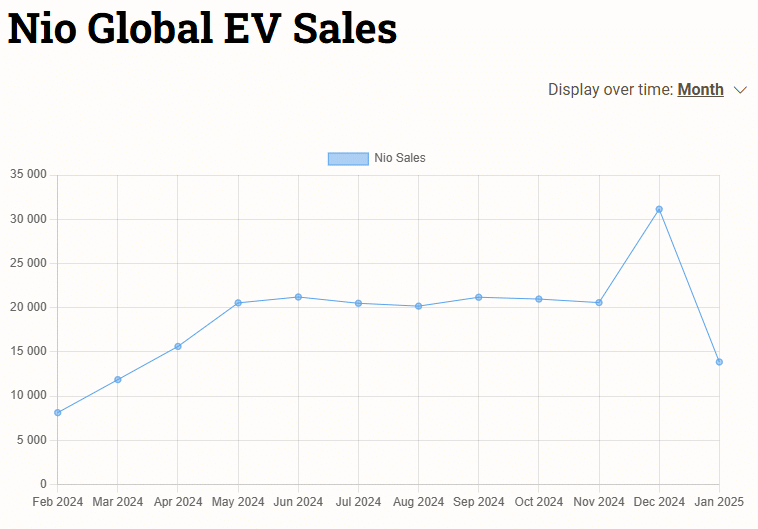

Nio group sold 13,863 passenger NEVs in January 2025, down 55.5% from 31,138 in December but up 37.9% from 10,059 the year before. Only the L60 SUV sold 5,912 units for Onvo, down 44% from 10,528 in December. Many analysts have speculated that Onvo and Nio vehicles, particularly the ES6 SUV, may cannibalize.

Xiaomi sold nearly 20,000 SU7 sedans, its lone car. China EV DataTracker estimates January sales at 21,960 units, down 12.3% from 25,035 in December.